This commentary highlights tactical views across equities and fixed income following the Fed’s renewed easing.

-

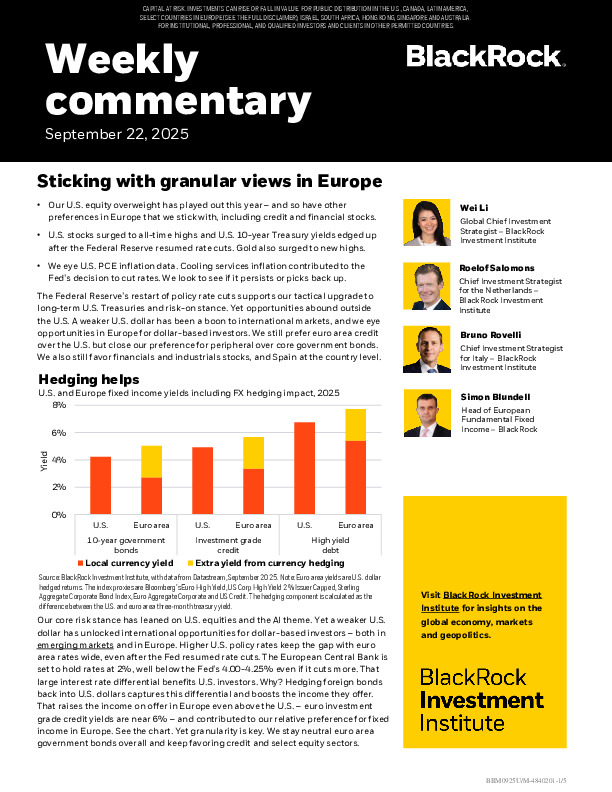

Europe Credit Edge: Euro area investment grade credit yields near 6% (USD-hedged) now outcompete U.S. credit, reinforcing a preference for corporate over sovereign exposure.

-

Equity Granularity: Select European sectors—financials, industrials, and utilities—continue to show relative strength; Spain remains favored for growth and EM linkages.

-

Global Positioning: U.S. equities remain overweight on AI-driven earnings; Japan stands out strategically on reforms and inflation dynamics.

How should investors balance U.S. resilience with Europe’s yield and sector opportunities? Explore the full report for actionable insights.

limited_access.body_anonymous